How to organize business receipts for success

Keeping your business receipts organized is a critical aspect of maintaining financial health and success. Most importantly, it allows you to keep more accurate records, which in turn facilitates more accurate financial analysis. Specifically, well-organized receipts serve as a reliable trail of expenses. This helps you to make sure you’ve accounted for all transactions and have everything properly categorized for tax purposes.

Moreover, having accurate financial records and analysis, all transactions accounted for, and expenses properly categorized for taxes has three core benefits. Firstly, it can help you claim legitimate deductions, minimize tax liabilities, and comply with regulatory requirements. Secondly, it can provide valuable insights into the company’s spending patterns. Lastly, it fosters transparency and accountability.

Accordingly, in this guide, we’ll walk you through the four steps listed below. This will help you organize business receipts better and choose the right office supplies to make it easier.

- Understand the types of business receipts

- Set up a system to organize receipts

- Plan to collect and store business receipts

- Create categories to organize receipts

More articles you might like

- How to Make Avery File Folder Labels

- 7 Quick & Easy Tips for “How Do I Organize My Desk?”

- 21 Awesome Name Tag Ideas to Boost Your Next Event

1) Understand the types of business receipts

As previously mentioned, properly categorizing receipts is most important for accurate tax reporting. Thus, understanding the different types of business receipts is essential so that you can maximize your returns and avoid penalties. However, understand. However, it can also help you with general accounting and business planning as well.

Best categories to organize receipts

Below are the different types of business receipts that the IRS recommends saving:

- Gross receipts, which include cash register tapes, deposit information (cash and credit sales), invoices, and forms such as 1099-MISC.

- Receipts from purchases and raw materials. These should show the amount paid and confirm that they were necessary business purchases. Some examples include canceled checks or other documents that identify the payee, amount, and proof of payment/electronic fund transfers.

- Cash register tape receipts.

- Credit card receipts and statements.

- Invoices for goods purchased or services rendered.

- Petty cash slips for small cash payments.

2) Set up a system to organize your receipts

Setting up a system to organize your receipts is a crucial step in streamlining record-keeping. So, it’s important to choose the right tools and supplies.

Firstly, consider implementing a filing system for storing receipts on a yearly basis. This could take the form of a dedicated cabinet, drawer, or file box for this purpose. When filing, customized file folder labels make everything easy to find and retrieve. To this end, we recommend Avery 5366 file folder labels with TrueBlock® technology because they’re easy to print and have a special backing that completely covers old file folder labels. Then, when preparing for the end of the fiscal year, move your receipts to long-term storage.

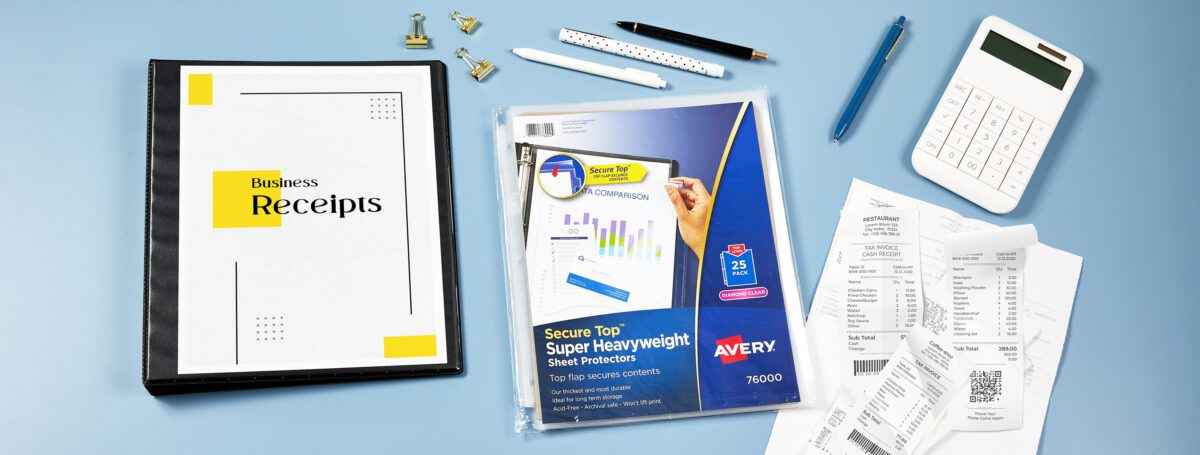

For more daily and monthly needs, consider using a binder to collect receipts before they enter the filing system. Then, equip the binder with sheet protectors for quick storage, dividers to sort receipts as you collect them, and spine inserts along with a cover sheet for easy identification. If you often deal with receipt books, Avery 73556 document holders are ideal for keeping bulky items organized. What’s more, to enhance the professional appearance of your organizational system, leverage Avery Design and Print Online (ADPO). ADPO is a free online design tool that allows you to quickly create custom file folder labels and more in minutes.

Lastly, create a dedicated workspace for managing receipts. Whether that means a separate space or just an area of your desk, it will help you have a more systematic and efficient process. This definitely makes it easier to stay on top of your receipts. And if you need help organizing your desk, this article has great tips to help you maximize space and efficiency.

Benefits of physical receipts vs digital

All in all, the choice between physical and digital receipts depends on individual preferences, habits, and specific requirements. In our experience, a hybrid approach is the most effective method. With this approach you would use physical receipts for day-to-day records and digital receipts for long-term records management. Read more about the records management life cycle and best practices here.

With that in mind, here is a breakdown of the pros and cons of keeping physical receipts versus digital ones.

| Physical Receipts | Digital Receipts |

|---|---|

| Tangible record | Convenience and accessibility |

| Easy to access | Search functions |

| Backup in case of technical issues | Environmentally friendly |

| Visual confirmation | Integration with software |

3) Plan to collect and store business receipts

As has been noted, we find a hybrid plan for collecting and storing business receipts to be the most effective. The most important thing to remember is to stay on top of your receipts. With that in mind, you should plan to loosely sort and collect receipts as you go. As to where to store receipts, a binder is perfect for storing receipts as you collect them. Then, transfer your receipts from your binder to file storage monthly or weekly, as needed. Finally, at the end of the year, scan paper receipts to store them digitally for long-term record management.

4) Create categories to organize receipts

As stated previously in this article, there are six different types of business receipts that the IRS recommends saving. Thus, these are generally the best categories for organizing receipts. However, at the end of the day, it’s more important that you create meaningful categories rather than follow a list. For example, say you are an online-only business, you may not need a category for cash register tape receipts. Or, you may want to categorize receipts more in depth so you can analyze the cost of production.

How to organize receipts in a binder

Firstly, make sure you start out with a quality binder that can a) accommodate the number of receipts you collect weekly or monthly and b) won’t fall apart from wear and tear. For this purpose, we recommend shopping for Avery heavy-duty binders and filtering by ring size so that you can pick one that suits your receipt volume. Our overall top pick is this 1″ heavy-duty view binder with 275 sheet capacity.

Next, use dividers so that your temporary binder storage matches your long-term filing system. This is key because it makes it easier to move receipts from the binder to file folders. Because the IRS generally recommends keeping six types of business receipts, we recommend Avery 11133 eight-tab dividers. This will accommodate the six types outlined by the IRS and give you flexibility. Moreover, these dividers have a convenient table of contents page that you can customize for free using Avery Design and Print Online.

Finally, use sheet protectors to store receipts within the sections of your binder. We recommend using diamond-clear super heavyweight sheet protectors with a secure top so that they’re well-protected and don’t fall out.

How to keep personal and business receipts separate

Ideally, the best way to keep personal and business receipts separate is to use separate filing systems. In this scenario, you would have separate binders for the two. Additionally, you could color code the binders and filing system for quick identification. That being said, at minimum you should keep a separate pocket in your receipt binder solely for personal receipts. In fact, even if you have separate filing systems, a “personal receipts” pocket in your business folder is still a great idea for personal expenses incurred at work.

Start organizing your receipts better today

Ultimately, understanding the types of business receipts is not just about tax compliance. It’s a strategic move to maximize returns, claim legitimate deductions, and gain insights into spending patterns. Meanwhile, setting up an efficient system with the right tools ensures that the process is both systematic and user-friendly. For these reasons we recommend leveraging Avery products and free tools. For example, using Avery Design and Print online to create customized file folder labels for filing your receipts. You can print file folders yourself, or even have them printed for you using the Avery WePrint® service.

As suggested in this article, using both physical and digital receipts allows for day-to-day convenience while maintaining a long-term digital record. Furthermore, staying organized throughout the year, from sorting and collecting receipts to creating meaningful categories, ensures a smooth transition into tax season and audits. By following these steps, you can foster transparency, accountability, and financial well-being for your business.

Share these insights with your peers and get more ideas for your business by connecting with Avery on LinkedIn. You can also join the conversation on Instagram and Facebook.